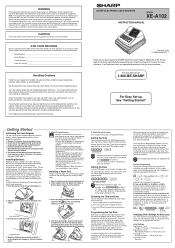

Sharp XEA102 Support Question

Find answers below for this question about Sharp XEA102 - Cash Register.Need a Sharp XEA102 manual? We have 3 online manuals for this item!

Question posted by speerswm53 on February 3rd, 2022

Register Won't Recognize Correct Tax Rate

Current Answers

Answer #1: Posted by hzplj9 on February 3rd, 2022 2:30 PM

https://www.manualslib.com/manual/203159/Sharp-Xe-A102.html

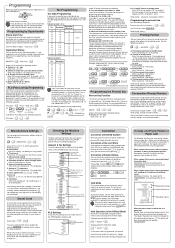

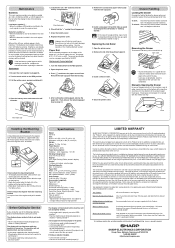

It would appear you are in the U.S. so the Tax department for your company should be able to help. Have you actually completed a reset? One can often confuse a reset to resetting departments rather than a complete back to factory reset. This involves removing the backup battery and the power for at least 15 minutes to allow any charge to drain away. The start again as if it is a new till. I am no Tax expert so can only advise from an electronic perspective and a complete reset cures a lot of ills. make sure you have a backup of any data held in the till before doing a full reset.

Hope I have enabled you to solve your dilemma.

Answer #2: Posted by SonuKumar on February 4th, 2022 9:44 AM

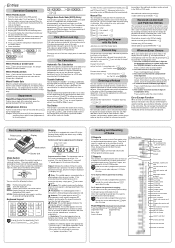

How do I fix my Sharp cash register?

Plug in the cash register's power cord and turn on the register. Press and hold the "Journal Feed" and "Receipt Feed" keys as you turn the key to the SRV position-the one without the apostrophe afterwards. Your Sharp cash register is now reset.

Please respond to my effort to provide you with the best possible solution by using the "Acceptable Solution" and/or the "Helpful" buttons when the answer has proven to be helpful.

Regards,

Sonu

Your search handyman for all e-support needs!!

Answer #3: Posted by Rinassihlahla on February 3rd, 2022 12:48 PM

Examine your tax code as well as your Personal Allowance.

Check to see if your tax code has changed, and report any changes to HM Revenue and Customs (HMRC).

your employer's or pension provider's information should be updated

see a forecast of how much tax you'll owe for the entire tax year

Check and adjust your projections of how much money you'll make from your jobs, pensions, and savings interest from banks and building societies.

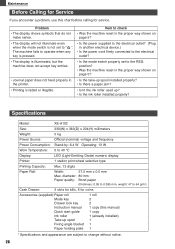

Related Sharp XEA102 Manual Pages

Similar Questions

it was working fine yesterday, it printed the Z report & was turned off for the night, this morn...